Electric Cost Of Mainitaing Plug In Vehicle Tax. South australia and nsw have announced plans to do so. Follow the steps for 1 of these options:

The tax credit extends through dec. There will also be an expensive car tax supplement for electric cars exceeding.

The Maximum Credit Is Either $4,000 Or 30% Of The Sales Price Of The Vehicle—Whichever Is Lower.

South australia and nsw have announced plans to do so.

Reduction Of The Gross List Price.

So if the vehicle’s cost is more than $13,333.33, the.

The Bik Tax Is Determined.

Images References :

Source: cleantechnica.com

Source: cleantechnica.com

US Plugin Electric Vehicle Breakdown By Size Class (Chart) CleanTechnica, Follow the steps for 1 of these options: People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

Source: insideevs.com

Source: insideevs.com

These 19 PlugIn Electric Cars Qualify For Full 7,500 Tax Credit, For example, the hyundai kona electric costs zero in tax, but the diesel version emits 112g/km. 55 reduces electric vehicle registration fees by 30 percent starting in 2028.

Source: www.everycrsreport.com

Source: www.everycrsreport.com

The PlugIn Electric Vehicle Tax Credit, Reduction of the gross list price. You have to buy the car for your personal use (that is, not for.

Source: tilamuski.github.io

Source: tilamuski.github.io

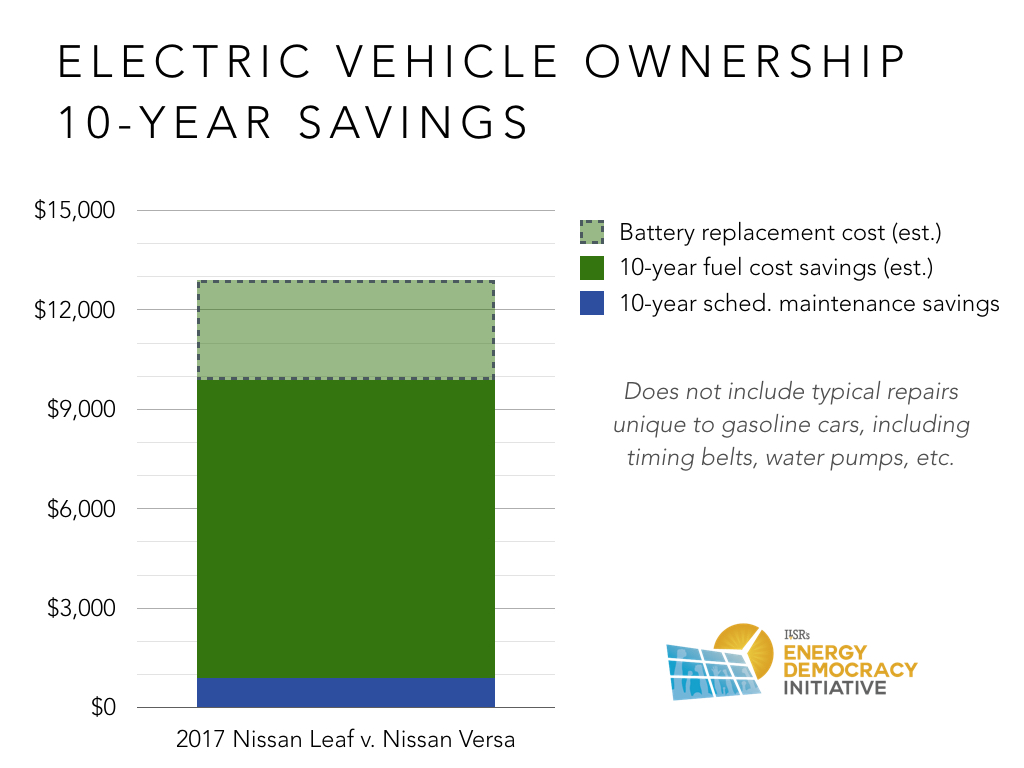

0 Down Car Evs Savings Cost Electric Breakdown Gas Cars Vehicle, Reduction of the gross list price. These individuals will now need to pay ved on their vehicles.

Source: www.ev-volumes.com

Source: www.ev-volumes.com

EVVolumes The Electric Vehicle World Sales Database, To add an asset, or select the asset then. This measure will impact on individuals who own an electric car, van or motorcycle.

![How much does it cost to charge an electric car? [Infographic]](https://electriccarhome.co.uk/wp-content/uploads/2019/05/typical-ev-charging-costs.png?x51094) Source: electriccarhome.co.uk

Source: electriccarhome.co.uk

How much does it cost to charge an electric car? [Infographic], Federal incentives include a 30% tax credit up to $1,000 for electric car chargers and installation costs. Once this tax exemption expires, the vehicle tax.

Source: ilsr.org

Source: ilsr.org

Six Reasons Your Next Car Should Be Electric Institute for Local Self, Federal incentives for buying or leasing zevs are available through two programs, based on vehicle type: The bik tax is determined.

Source: creditwalls.blogspot.com

Source: creditwalls.blogspot.com

Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit, There will also be an expensive car tax supplement for electric cars exceeding. Reduction of the gross list price.

Source: www.valuepenguin.com

Source: www.valuepenguin.com

Buying an Electric Car? For Savings, Time Could Be of the Essence, The bik tax is determined. How much tax, vat and fees for buying a new electric vehicle in norway is 2023.

Source: www.kbb.com

Source: www.kbb.com

How Much Does it Cost to Charge an Electric Car? Kelley Blue Book, The tax credit extends through dec. These individuals will now need to pay ved on their vehicles.

The Tax Credit Extends Through Dec.

Starting in january, you’ll be able to get an electric vehicle tax credit of up to $7,500 without having to wait for the irs to process.

This Measure Will Impact On Individuals Who Own An Electric Car, Van Or Motorcycle.

Federal tax credit up to $7,500!